Your Partner in Easy CBAM Reporting

We provide tailored CBAM solutions:

- Expert CBAM Reporting

- Verified and Validated report

- CBAM Consulting & software

- Reduce your Carbon Tax

Book your consultation Now

Carbon Border Adjustment Mechanism (CBAM)

The Carbon Border Adjustment Mechanism (CBAM) is an environmental trade policy introduced by the European Union. In simple terms, it is a carbon tariff on imports of specific carbon-intensive goods into the EU.

EU carbon border adjustment mechanism is aimed at putting a fair price on the carbon emissions embedded in imported or exported goods to the EU, ensuring that the EU’s climate efforts are not compromised by importing products from countries with less stringent environmental regulations.

This levels the playing field between EU producers, who already pay for their carbon emissions under the EU Emissions Trading System (EU ETS), and foreign competitors who may not.

Does EU CBAM Affect Your Business?

If you export aluminium, steel, iron, fertilisers, hydrogen, electrical energy, or cement to the EU, this concerns you. From 1 January 2025, all imports of these goods must come with detailed CBAM emissions reporting. The reporting must follow the EU’s CBAM methodology.

Failing to comply can trigger hefty CBAM fines of ₹900 to ₹4,500 per tonne of unreported CO₂.

Across India’s industrial belt, factory managers already juggle orders every Monday morning. Now, many must also prepare quarterly CBAM reports. It adds new pressure to already packed schedules. This is not just paperwork. Accurate reporting can decide whether your next big export order goes through.

What Is CBAM & Why Was It Created?

At its core, CBAM tackles “carbon leakage,” when production moves to countries with weaker climate rules to save costs. The EU wants a level playing field. Imported goods must pay a carbon price equivalent to products made within Europe.

For Indian manufacturers, this means your emissions volumes are under scrutiny. Unlike the EU’s Emissions Trading System (ETS), which operates on a cap-and-trade basis, CBAM implementation requires a transparent declaration of emissions but currently no carbon permits are traded (Normative, 2025).

Products Covered Under the CBAM List

Initially, CBAM EU applies to imports of the most carbon-intensive goods from specific sectors. The transitional phase, which began in October 2023, covers the following sectors:

- Cement

- Iron and Steel

- Aluminium

- Fertilisers

- Electricity

- Hydrogen

It also covers select downstream products, like screws and bolts, widening the compliance net. If your exports include these, compliance is unavoidable (CBAM goods list).

The Real Financial Impact for Indian Exporters

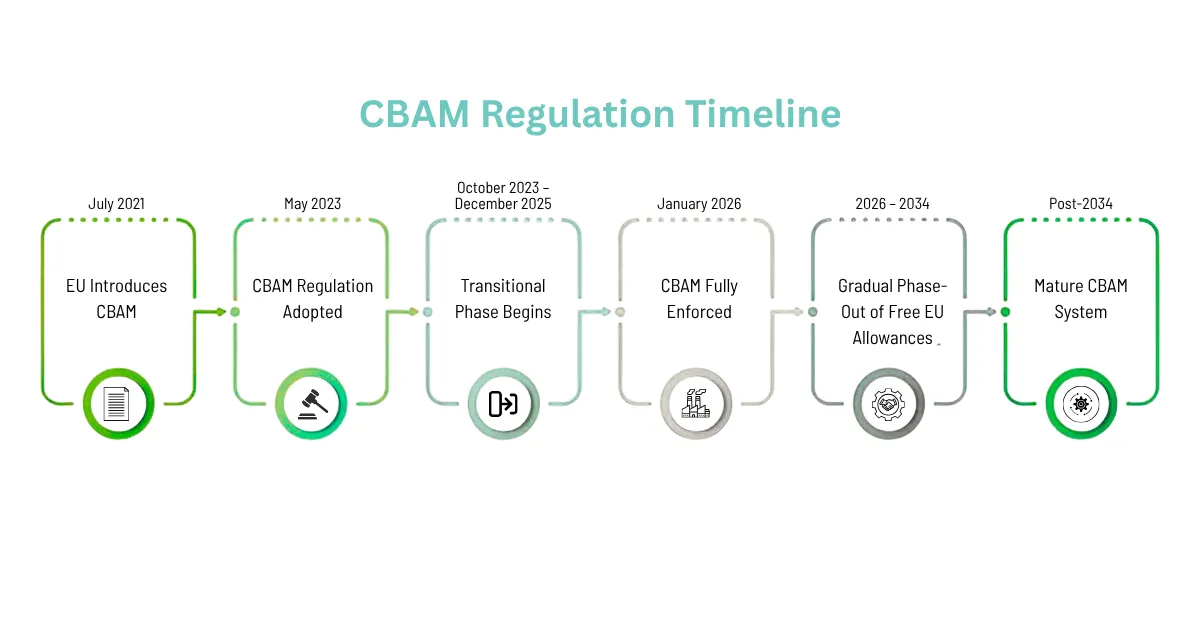

During the CBAM transitional period (Oct 2023 to Dec 2025), importers must report embedded emissions using default emission factors initially. From July 2024 onwards, authentic emissions data must be submitted, or you risk CBAM fines ranging from ₹900 to ₹4,500 per tonne of missed CO₂.

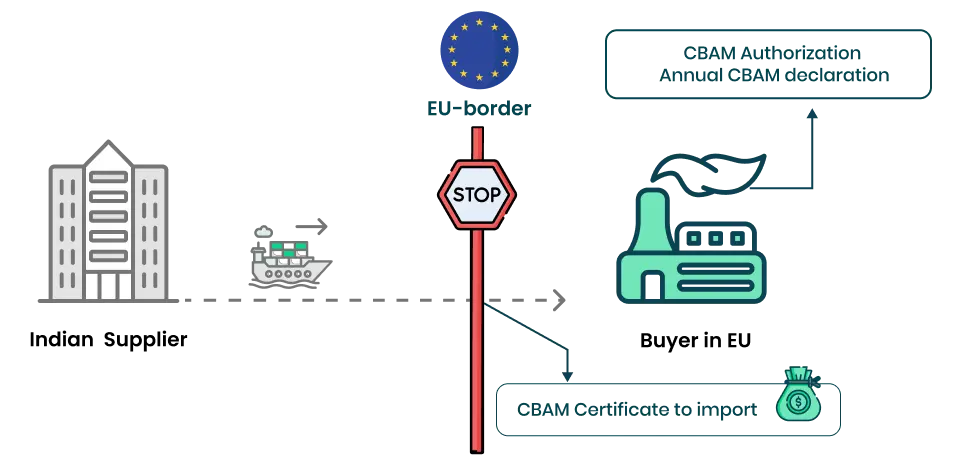

Consider the finance manager who is now faced with balancing rising compliance costs. Should they absorb these or pass them on to clients? By 2026, with the CBAM definitive period, importers must purchase CBAM certificates corresponding to their emissions, adding a recurring cost.

Timeline and What Indian Exporters Must Prepare For

- October 2023: CBAM transitional period reporting starts

- January 2025: Mandatory use of EU CBAM reporting templates

- December 2025: Transitional period ends

- January 2026: Full financial CBAM certificate purchase required

- 2034: Phase-out of ETS free allowances completed

Early investment in emissions tracking and supplier data management is not optional; it’s necessary for survival.

The Burden on Indian Steel and Aluminium Industries

India’s steel industry exports around 25 percent of its output to Europe. With carbon intensity in Indian steel production up to 2.5 tCO₂/tonne, significantly above global standards, CBAM pressures are substantial.

Small and medium steel producers face stiffer challenges in compliance due to limited technological and reporting infrastructure. This translates to potentially losing market share to greener competitors like South Korea or Turkey, who already boast lower carbon footprints.

India’s Strategic Response to CBAM Challenges

India’s government and industry leaders are rallying around several measures:

- Financial Incentives and Technology Upgradation: Encouraging green hydrogen use, carbon capture tech, and clean energy adoption in the steel and aluminium sectors.

- Capacity Building for SMEs: Supporting smaller producers in building compliance and reporting capabilities.

- Trade Diplomacy: Challenging CBAM regulation EU compatibility while negotiating better terms.

- Carbon Credit Market Engagement: Exploring international carbon credit trading to offset liabilities.

Together, these strategies aim to cushion the financial shock and position India as a responsible player in global climate efforts.

Download CBAM Fact sheet

Indian Exporters: Practical CBAM Reporting Tips

Let’s say you import 1,000 tonnes of aluminium from South Africa to Rotterdam in May 2024. The steps are:

- Confirm the import is a CBAM-covered product.

- Gather actual emissions data from your supplier using the EU’s CBAM methodology.

- Suppliers must provide this verified data by July 2024.

- Submit a detailed emissions report by 31 July 2024, including direct and certain indirect emissions.

- Use EU default values only where supplier data is unavailable, but transition to actual data as soon as possible to avoid CBAM fines.

Prepare to file these reports quarterly.

Who Qualifies as a CBAM Declarant in India

If your Indian company exports goods to the EU worth more than ₹13,500 (€150) a year, you are officially a CBAM declarant.

This means you need to report CBAM carbon data and buy CBAM certificates. It is not just the big multinationals headquartered in India. Even European subsidiaries of Indian companies importing CBAM goods fall under the same rules (PwC India, 2024).

Perhaps you’re already feeling a bit overwhelmed. You’re not alone.

Helping Indian SMEs Tackle CBAM Compliance

Small and medium enterprises are the backbone of India’s export economy. Steel, aluminium, and chemicals are major CBAM-covered products.

Many SMEs struggle because they don’t have dedicated teams or advanced tools for CBAM reporting. Missing quarterly reports or submitting incorrect data can trigger steep CBAM fines. It can also put EU market access at risk.

So, what’s the way forward? Start by building capacity gradually. Affordable emissions measurement tools help. Partnering with consultants can reduce errors.

Industry associations and government bodies can support SMEs with training, green technology subsidies, and simplified CBAM reporting templates.

Early adopters of transparent carbon management often gain unexpected advantages. Imagine a small steel exporter in Gujarat tracking emissions for just one line of production. They find inefficiencies, save money, and attract buyers who value sustainability. They are punching above their weight.

How Technology Simplifies CBAM Compliance

Tracking emissions across multiple suppliers and facilities is overwhelming if done manually. Spreadsheets often fail.

Technology makes it manageable. Digital carbon accounting platforms, blockchain-based traceability, and AI-powered analytics automate calculations. They verify supplier data and generate audit-ready reports.

Several Indian startups and consulting firms now provide solutions tailored to local exporters. Beyond compliance, these tools offer insights into your CBAM carbon data.

Perhaps you discover that one supplier produces most of your emissions or that small changes in production save both costs and carbon.

Investing early in technology can turn regulatory pressure into a strategic advantage. What once felt like a headache becomes an opportunity.

Why It Matters?

Have you ever wondered why the EU emphasizes carbon reporting? It is about fair trade and sustainability.

For Indian exporters, CBAM compliance isn’t just a rule to follow. It’s a chance to rethink operations, reduce costs, and gain a competitive edge.

Take it step by step. Use technology. Track emissions. What seems like a burden can become a real growth opportunity.

Conclusion: Turning Challenges into Opportunities

CBAM is changing the rules of global trade. For Indian exporters, it is pushing businesses to innovate and green their operations.

Yes, compliance can feel complex and costly. But it is also a chance to emerge as sustainability leaders. Early and transparent CBAM reporting, investment in low-carbon technology, and close supplier coordination are keys to staying competitive in the EU.

Faced with CBAM, India can do more than just comply. It can lead, securing its role in a carbon-conscious global economy.

Sector We Covered

CBAM Compliance & Consulting for Every Required Sector

Iron & Steel

Tractors

Foundry

Fasteners

Aluminium

FAQs on CBAM for Indian Exporters

1. What is CBAM and why does it matter to Indian exporters?

CBAM is an EU regulation that adds carbon costs to imports based on the greenhouse gas emissions in products like steel, aluminium, cement, and fertilisers. For Indian exporters, this means accounting for your goods’ carbon footprint when exporting to the EU. Failing to comply can lead to CBAM fines and lost market access. The goal is to level the global carbon playing field and prevent carbon leakage (European Commission, 2024).

2. Which products from India are covered by CBAM?

CBAM covers aluminium, steel, cement, fertilisers, hydrogen, and electrical energy. Some downstream products, like screws and bolts, are also included. Exporters of these goods need to be especially careful with compliance.

3. What are the key reporting requirements and timelines?

Importers must submit detailed quarterly CBAM emissions reporting. The CBAM transitional period started in October 2023 and runs until December 2025. During this period, reporting is mandatory, but no financial penalties apply. Full implementation begins January 2026, requiring CBAM certificate purchases. Reports must use EU-approved CBAM reporting templates.

4. How can exporters gather accurate emissions data?

Work closely with suppliers to collect precise data on energy use, fuel consumption, and upstream emissions. This “carbon scorecard” replaces default emission values, which are only temporarily acceptable. Transparent and consistent CBAM carbon data is crucial.

5. Can default emission factors be used?

Yes, until 31 July 2024. After that, default values must be under 20 percent of total emissions for complex goods. Transition to primary CBAM carbon data is mandatory to avoid CBAM fines and protect your reputation.

6. What are the financial impacts?

During the CBAM transitional period, there are no penalties, but reporting must be accurate. From 2026, importers must buy CBAM certificates, priced according to the EU carbon market. Costs could rise 20 to 35 percent for exports like flat-rolled steel unless mitigated with greener production.

7. How does CBAM affect SMEs?

SMEs face greater challenges due to limited resources for emissions tracking and technology upgrades. Government support, capacity-building programs, and collaboration with export bodies are essential to prepare and compete fairly.

8. Are Scope 1, 2, and 3 emissions relevant?

CBAM covers direct (Scope 1) and indirect (Scope 2) emissions, plus certain upstream (Scope 3) emissions for complex goods. Fewer Scope 3 emissions are included compared to full corporate accounting, focusing mainly on key precursor materials.

9. How can exporters minimize CBAM costs?

Invest in clean technology and renewable energy. Monitor emissions closely with suppliers. Negotiate CBAM cost-sharing with EU customers. Developing low-carbon supply chains can provide a pricing advantage, as CBAM certificates reward cleaner goods.

10. What are the risks of non-compliance?

Beyond CBAM fines up to ₹4,500 per tonne of CO₂, poor compliance risks losing EU contracts and market share. The EU monitors emissions transparency closely. Early investment in accurate reporting and data validation protects both reputation and revenue